Financial New Year’s resolutions are really common, but they can be some of the toughest to stick with. If you choose the right resolutions, though, and use the right tools, you should be able to make a big positive difference in your finances this year.

Here are seven different resolutions you might make and a bunch of resources that will help you out.

One quick note: when making your resolutions, make sure they’re specific enough that you’ll be able to actually monitor your progress. That’s one of the most important parts of setting a good goal.

According to a 2013 Gallup poll, only 32% of surveyed Americans create a detailed monthly budget.

I won’t lie to you — it’s not easy. You’ll have to make some calculations and then use a lot of willpower to stick to the budget that you set. Fortunately, there are a few helpful tools out there.

We’ve shown you great Excel budget templates, given you an example of how to create a custom personal budget, detailed 7 baby steps to finally start budgeting, showed you how to manage your financial life with Mint, explained a Google Forms budgeting method, and we post new budgeting tips and tricks all the time right here in our Finance section.

With all of the resources around here, you should be able to find the best tool for you. Then all you need to do is start using it!

This is a really common one, and it’s probably a resolution that everyone should make. No matter how much you’re saving, it’s not a bad idea to save more! However, just saying “save more” isn’t a very good resolution: you need a specific savings plan.

How much do you want to save? When do you want to have that much money? A common goal is to have an emergency fund that could cover three months of expenses, and that’s a great place to start (don’t forget saving for retirement, though).

Once you’ve figured out how much you want to save, just divide that number by 12, and that’s how much you need to put away each month. Sticking to that goal can be difficult, which is why using a budget app to help you save is a good idea. Set a goal using your chosen app, and make sure it sends you notifications if you aren’t sticking to the plan! Now, adopt some good financial habits for the new year, and you’ll be on your way.

Another resolution that needs more detail — do you want to completely erase your debt by the end of the year? Cut it in half? Pay off your credit cards and consolidate your student loans? Set a specific goal and come up with a timeline. Make sure it’s a goal that you can meet, too, so you don’t get discouraged.

Now the hard part starts. Read Joel’s fantastic article on the fastest way out of debt to get the hard truths on what you’re going to need to do. You can start by creating an aggressive budget and sticking to it. You’ll also need a good long-term plan for paying off your debts. Hopefully you won’t have to deal with debt collectors, but if you think you might, having a plan for that will help, too.

Putting money in the stock market might sound like a terribly risky affair, but in the long term, it’s actually a fairly stable place to park your money — the generally accepted guideline is that you can expect a 6–7% return if your money is invested for 10 years or more. It’s a good bet to take—but you have to get started!

You don’t have to learn everything about investing to get started: you just have to get started. There are a lot of apps and services out there that let you invest a little bit at a time, and we’ve detailed a number of ways to invest faster and cheaper than you can in more traditional ways.

Read up on some good investing websites, and get started!

Bad spending habits are easy to pick up, and they’re very hard to get rid of. Maybe you spend too much on your tech obsession, or your bad Facebook habits are costing you money. Maybe you just don’t have enough self-control when it comes to shopping.

Beyond having a well-planned budget, your best bet is probably to tackle these in the same way you would tackle other bad habits: with cool apps! We’ve covered gamifying your entire life with Habitica, using micro-habits to spur change, and even how to get rid of bad habits with other bad habits.

The first step is identifying your bad habits, and then committing to changing them. That’s often the hardest part.

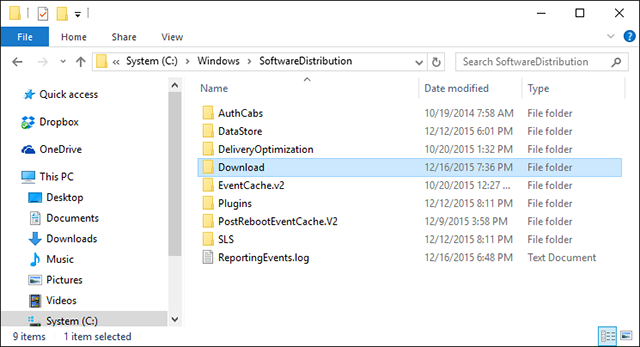

Automation has been a hot topic over the past couple years — and why shouldn’t it be? Having tasks get done automatically is a great way to save yourself time and effort while you’re accomplishing other things you need to do. This is especially true with your finances; if you can save money without having to lift a finger, why wouldn’t you?

One of the most basic tools for automation, and a favorite around MakeUseOf, is If This, Then That (IFTTT). Here are five ways IFTTT can save you money at home; start with those, and come up with some of your own! You can use similar tricks to always score good deals online, and you can use Google Alerts for the same purpose.

Combine those with apps that automatically help you save, and you’ll be getting a lot done without putting in any effort.

Whether impulse spending is a bad habit of yours or not, it’s likely that you don’t always comparison shop, look for coupons, and check Craigslist and eBay before you make a purchase. It’s time to change that this year. In resolution-speak, you might set a goal of “one impulse purchase per month” or “spend one hour shopping around for anything that costs more than $100.”

There are a lot of strategies for doing this. Check the best places to buy used stuff, do some comparison shopping, use the best coupon sites (or coupon-finding browser extensions) to find good deals, find a community of lenders and borrowers near you, or just learn how to make things so you don’t have to buy them in the first place. All of these will help you make sure that every dollar you spend is a good one spent.

Whether you decide to take on just one of these resolutions, a few of them, or all seven, it’s time to commit to making 2016 a year of better finances. Through saving more, getting out of debt, and spending smarter, you can relieve yourself of the emotional burden of financial difficulties and get closer to your goals. Why would you not do that?

Have you set a financial resolution this year? What’s your goal, and how do you plan on meeting it? Will you be using any specific tools to help you? Share in the comments below so we can be inspired to set some goals for ourselves!

Image credits: Nattapol Sritongcom via Shutterstock.com, wrangler via Shutterstock.com

Is It Finally Time to Buy More iCloud Storage?

Is It Finally Time to Buy More iCloud Storage? Warlock: Master of the Arcane — Just One More Turn

Warlock: Master of the Arcane — Just One More Turn Mortal Kombat X Guide: How to Play Ermac

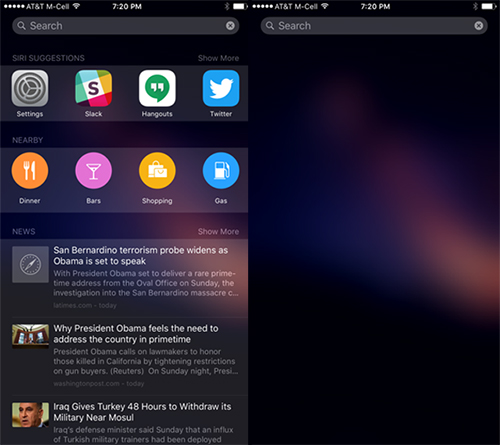

Mortal Kombat X Guide: How to Play Ermac Clean Up Spotlight Search by Getting Rid of Siri Suggestions

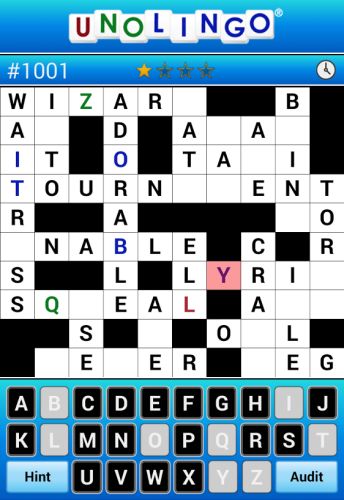

Clean Up Spotlight Search by Getting Rid of Siri Suggestions Words Without Friends: 7 Mind-Bending Single-Player Word Games

Words Without Friends: 7 Mind-Bending Single-Player Word Games