In Inflation and Gold Part 1 we reviewed the some of the principle reasons that gold is inherently deflationary in nature.

Such examples include one of the reasons the United States rid itself of the gold standard as when economic contraction occurred, the relationship between physical dollars and the peg to gold forced interest rates higher which resulted in further economic contraction.

Thus, we didn't have recessions but outright depressions on a regular basis (aprox every 8 years).

Furthermore the mathematical relationship between inflation and gold as it pertains to gold being denominated in US Dollars is inverse.

The higher the price in gold, the more dollars are required to purchase it. Such an increase in demand for dollars to purchase gold puts upward pressure on the dollar, not downward.

As such, the bid for gold and other commodities denominated in US Dollars is inherently deflationary in nature.

In Part 2 of Inflation and Gold we'll begin to look at empirical evidence by way of basic statistics that show using gold as a hedge against inflation may not be such a good idea.

Inflation And Gold: Change in CPI vs Change in Gold

First we will analyze the annual change in CPI versus the annual change in the price of gold spanning from 1924 to 2010. All data has been obtained from the Federal Reserve.

The chart plots the linear regression between the change in CPI (x) versus the change in gold (y).

The relationship can be explained by y = 0.546X + 0.041.

As you can see, the relationship is positive as you would think it would be as an increase in CPI represents an increase in prices. Thus as the change in CPI is positive, so is the change in Gold.

However, this view alone is not enough to fully understand the relationship between inflation and gold.

We need to look at how strong the relationship is.

We find that the R value is 0.135 with is why the relationship is slightly positive.

If you think back to Stats 101 you'll remember that R values range from +1 to -1 with +1 representing a 100% positive correlation and -1 representing a 100% negative correlation with 0 indicating no correlation.

As you can see a value of 0.135 is much closer to 0 than it is +1 or -1 thus the correlation between the change in CPI (how inflation is measured) and the change in Gold is almost non existent.

To further illustrate how poorly the change in CPI is as a predictor of the change in gold valuation, we then look to R^2. R^2 in this sample po[censored] tion comes in at 0.018 indicating that only 1.8% of the price of gold is predicted by changes in CPI.

Since CPI is a basket of assets of various weights, we cannot be too surprised with the poor fit of this model.

In Part 3 of Inflation and Gold we will seek to better understand the notion of gold as a hedge against inflation is valid by further examining the relationship of Gold and CPI.

The results were alarming, even to us.

Guide: Everything You Need To Know About Pokémon Omega Ruby & Alpha Sapphires Secret Bases

Guide: Everything You Need To Know About Pokémon Omega Ruby & Alpha Sapphires Secret Bases The Wind Waker Walkthrough – Nayru’s Pearl –

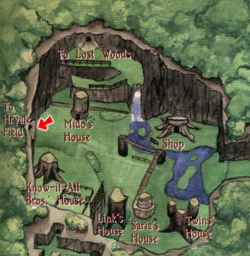

The Wind Waker Walkthrough – Nayru’s Pearl –  Ocarina of Time Walkthrough – Princess of Destiny –

Ocarina of Time Walkthrough – Princess of Destiny –  Skyward Sword Walkthorugh – Lanayru Mining Facility –

Skyward Sword Walkthorugh – Lanayru Mining Facility –  Pikmin 3 Guide - Pikmin Types and Abilities

Pikmin 3 Guide - Pikmin Types and Abilities