Online shopping is really convenient — but it can also be really dangerous. It’s easy to get caught up in browsing lists of things you don’t really need, and it’s far too simple to order them with a single click.

You’re not making it any easier on yourself by keeping up the bad habits listed below. Check them out and be honest with yourself — which ones are you guilty of? Share in the comments below and we’ll talk about good ways to turn them into better habits.

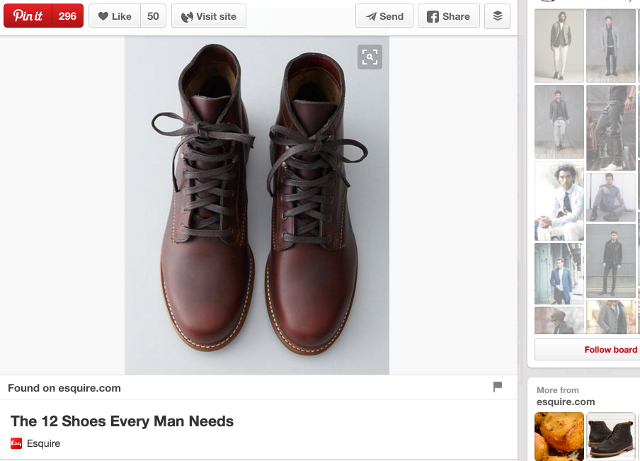

This is the first thing that has to go. Browsing products on Pinterest is like walking through the mall looking at stores and saying you’re not going to buy anything.

It could happen, but it requires a huge amount of willpower to stick to your shopping prohibition. The same goes when you’re browsing any website that contains images and details on a lot of products that you’ll probably like (which is especially true on Pinterest, as they’re really good at learning your preferences).

Instead, start filling your Pinterest feed with things that will inspire you to save money. Search for things like ‘combine clothes in new ways’, ‘thrifty outfits’, or ‘DIY organization ideas’. These are the kinds of things that will help you stop spending impulsively, but still be fun to look at.

Pinterest can be really useful if you know how to use it effectively, but you need to be a very disciplined when following boards and liking posts.

(Quick note: this goes for other social networks, too, especially Instgram. The outfit of the day tag, #OOTD, can lead to an urge to shop.)

Following brands on social media can be really useful; you can get exclusive coupons, for example, or find out when big sales are coming up. But you’ll also get exposed to an awful lot of marketing. It’s easy to fill up a good portion of your Facebook and Twitter feeds with ads and product recommendations from retailers, and that’s going to make it hard to stay disciplined and resist impulse shopping.

Not following any brands on social media is a good goal, but if you absolutely need to know what this week’s fashions are, just follow the companies that you buy from regularly. Don’t follow the companies you buy from once a year. It’s not nearly as entertaining or exciting, but it could save you a lot of money and lower the temptation you have to deal with every day.

Ah, online sales. How much extra money do you think you spend when your favorite retailer is having a sale? It always feels like you’re saving money, but usually what you’re doing is getting more for spending the same amount, or just spending more.

Obviously, if you can maintain your self-control, you can save quite a bit. However, it’s very difficult to resist temptation when you see that something you previously couldn’t afford is now on sale.

Some financial bloggers advise not shopping sales at all. Instead, they say to make a list of the things that you want and to go online and buy them, regardless of whether they’re on sale or not. This is certainly a viable strategy, but that’s not going to be everyone’s preferred choice.

If you do decide to keep shopping sales, make a budget first. Tell yourself how much you can spend before you start, and then only spend up to that limit.

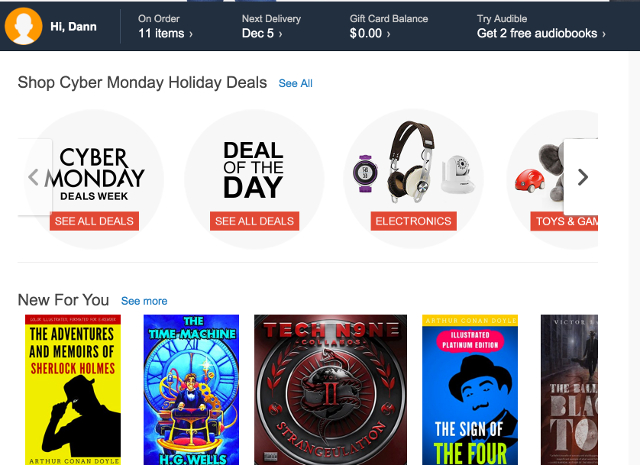

One of the reasons why it’s so easy to spend a lot of money online is because retailers make it so very easy. Amazon has it down to where you just need to click once — no entering credit information, no entering shipping details, no confirming the purchase, nothing. Just one click and it’s on the way. And that’s really dangerous (not only when you’re being tempted, either: my mother-in-law once accidentally used one-click purchasing to buy a $1,000 chair).

Even if you don’t use one-click ordering, keeping your credit on file at your favorite stores is not a good idea. Humans are lazy, and we try to minimize the effort that we need to use to accomplish things. Even little things — like entering your credit card information — can be a deterrent.

If nothing else, it gives you one more chance to reconsider your decision. Don’t let companies save your credit card information, and you’ll be more likely to make better decisions.

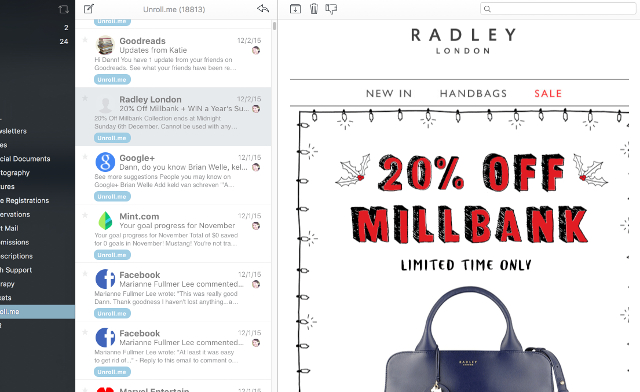

Just like following brands on social media, getting newsletters in your inbox with offers will expose you to a lot of marketing. And online marketers are really good at what they do — they know all the tricks. Which means you’re making yourself a lot more susceptible to making poorly planned purchases. And you’re cluttering your inbox, which is another thing you don’t want to deal with.

Just like with social media, if you can’t unsubscribe from all of the newsletters, stick with the ones from the brands that you buy from all the time. You’ll be more likely to actually save money with these. And if you can’t bear the thought of unsubscribing from them, use Unroll.me or another strategy to keep them from distracting you when you’re in your inbox.

Again, putting another step between you and a purchase is a good thing.

Related to both “window” shopping and browsing sales, allowing yourself to be distracted by the items that Amazon, Target, or any other online retailer presents to you when you’re buying something is bad. If you buy an Arduino starter kit, for example, Amazon will recommend a bunch of other Arduino-related things, and you’ll probably be tempted to buy them.

But if you didn’t set out to buy them in the first place, you almost certainly don’t need them. Sure, some would be nice, but if you didn’t think to put them on your list in the first place, and you’re thinking about buying those items, it’s probably due to advertising. And that’s not a good way to shop.

Remember that online retailers know a lot about you, and they know exactly what to put in front of you to make you spend more.

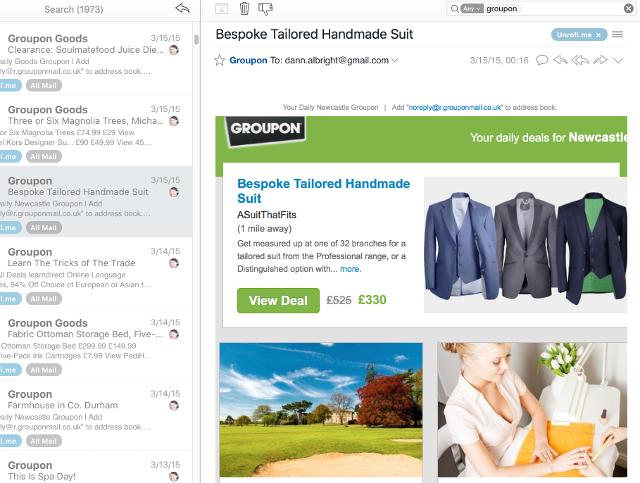

Groupon, LivingSocial, and other “social couponing” sites can save you a lot of money if you grab the right coupons. If you grab the wrong coupons, you could end up spending a lot on things that you don’t need — or, worse, forgetting about them and losing the value of the coupon.

The key is knowing when to see if there’s a Groupon that you’re interested in. If you want to buy something, and you think that you might be able to save on it with a Groupon, check out the site and search for what you need. If you want to go out to eat, take an affordable vacation, or go on a weekend outing, you’ll almost certainly be able to find what you want.

When you get emails from Groupon, however, you see what they want you to see. Groupons for specific stores, classes, and items that you never thought about before can look awfully appealing when you’re saving 50% or more (or if you think you’re saving that much).

But don’t get drawn into the black hole of buying Groupons; it feels like saving money, but it’s still spending. Unsubscribe, and hit the site when you think it would be useful.

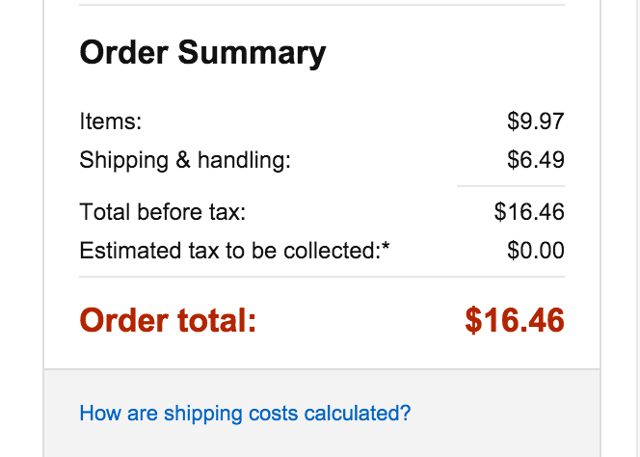

There are tons of ways to get free shipping online — so many, in fact, that paying for shipping is almost always a waste of money. On Amazon, you get free shipping if you spend over $35, which isn’t hard (even if you don’t get caught up in a sale).

Free shipping is also one of the awesome Amazon prime benefits (sign up for Prime here) that you should be taking advantage of. Other sites often have similar deals, where if you spend over a certain amount you don’t have to pay to have it delivered.

Where shipping really hits your finances is if you make a lot of small purchases — you often won’t reach the threshold, and you’ll pay a couple bucks for each item. It doesn’t seem like much at the time, so you don’t think about it, but it adds up over months and years.

Those little, one-off purchases are often impulse buys too, making them doubly bad for your budget (you do have a budget, don’t you?). Consolidate your purchases to save on shipping costs.

Being financially responsible isn’t always easy, and maintaining bad online habits can make it even harder. You don’t have to become a model of resisting temptation overnight– start with one or two of the above tips, and work your way from there. Or take on one each week over the course of a couple months. Just make sure you start somewhere.

And why not start reading some personal finance blogs while you’re at it? It will help keep your motivation and resistance to temptation up.

What bad habits cost you money online? Do you find yourself making impulse purchases or browsing sales? Do you get caught up in email newsletters? What have you done to help yourself resist the temptations online? Share your thoughts and tips below!

Image Credits:legs and shopping bags by haveseen via Shutterstock

Alchemy Mysteries: Prague Legends Walthrough (Text)

Alchemy Mysteries: Prague Legends Walthrough (Text) Metro: Last Light and The Problem of Ranger Mode

Metro: Last Light and The Problem of Ranger Mode What Is Error 451, and How Can It Make a Difference?

What Is Error 451, and How Can It Make a Difference? Gran Turismo 6 vs DriveClub HD Screenshot Comparison

Gran Turismo 6 vs DriveClub HD Screenshot Comparison Top 25 Goriest Games of all Time

Top 25 Goriest Games of all Time