In our beginner’s guide to managing your money with Mint, you saw how to add accounts, set up budgets, and make some tweaks to transactions. Once you have all that down, it’s time to step up to some more useful advanced features.

If you master these tips and tricks, you’ll be a real Mint expert!

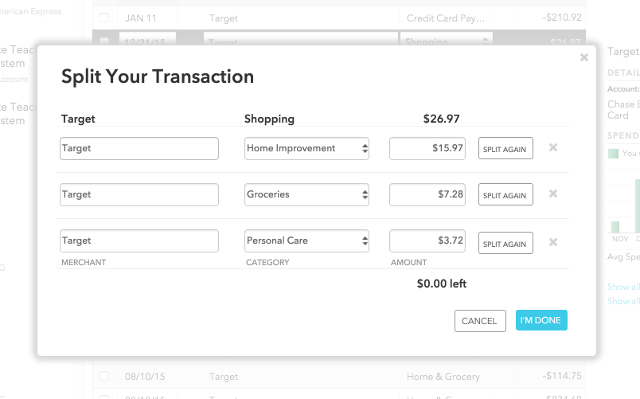

I don’t know about you, but when I go to a department store, I do a lot of different kinds of shopping. I might buy some groceries, some home-related items, occasionally electronics, sometimes gifts — it can vary a lot. That’s why classifying Target, for example, as “Shopping” or “Groceries” in the transactions list doesn’t provide enough detail for me.

That’s where splitting transactions comes in.

Let’s take this transaction for $26.97 as an example. Click on Edit Details to pull up the details pane, and then click the Split Transaction button in the top-right corner.

In the Split Your Transaction pane, you can split any expense into as many different categories as you want. Just enter the amount for each category you’d like to use, and hit Split Again if you need more categories. This is much more accurate than putting everything under a single catch-all category.

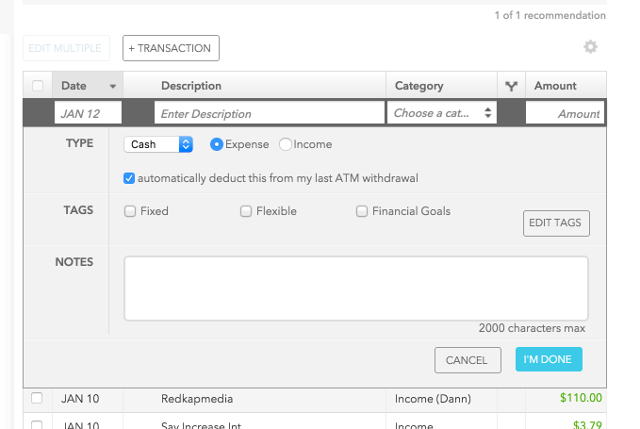

Monitoring cash transactions isn’t a strength of very many budgeting tools, but Mint can handle it pretty well if you take some time to enter your transactions. For this, you’ll need to learn to add transactions manually, which you’ll do with the + Transaction button at the top of the transactions list.

Make sure the drop-down says “Cash,” then choose either Expense or Income, add a description and a category, and enter the amount of the transaction.

Mint has the very nice feature of being able to deduct any cash expenditures from your last ATM withdrawal, so you don’t have the money detracted from your total twice (without this feature, you’d have a negative value for the ATM withdrawal and a negative one for the expense). It’s easier to leave this option checked, and I recommend managing cash this way.

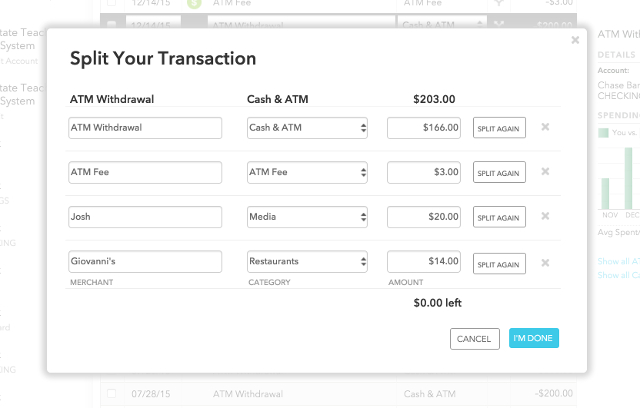

Without using this method, you’ll need to manually split your ATM withdrawal using the above method to categorize each transaction (which can also be done; see below). In this example, a $200 ATM withdrawal with a $3 fee has been reduced by $34, and that $34 has been put toward two other purchases. Again, this makes sure you’re not listing the same expenditures twice.

If a lot of your cash never hits a bank account, you can also choose to de-select “Automatically deduct this amount from my last ATM withdrawal,” which will more accurately represent your transactions. It’s not ideal, but it works. You might have to experiment with a couple different methods to see which is best for you if you want to track your cash.

If you have any other advice for managing cash, please share it in the comments, as this is a common question about using Mint!

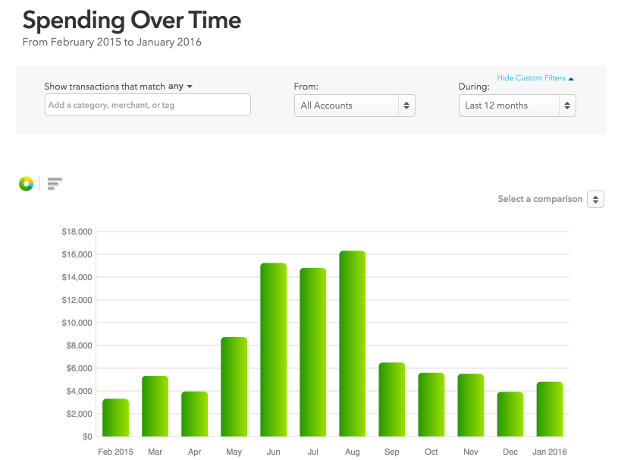

In addition to tracking budgets, Mint lets you do some very useful analyses on your finances. For example, you can see how your spending has been distributed between categories over the last month, last three months, last year, or over a custom time interval. You can see the value of your assets, debts, or net worth over time. You can view your expenses by category, or you could see where you’ve spent the most money by sorting by merchant.

All of these options are available in the Trends screen, and they’re easily found in the left menu bar. To tweak the settings, use the filters above the trends display; you can select specific accounts, set up time intervals, and even search for specific types of transactions or merchants. Some of the graphs can also be viewed as a pie chart; just click the pie chart above the graphs on the left side to change the format.

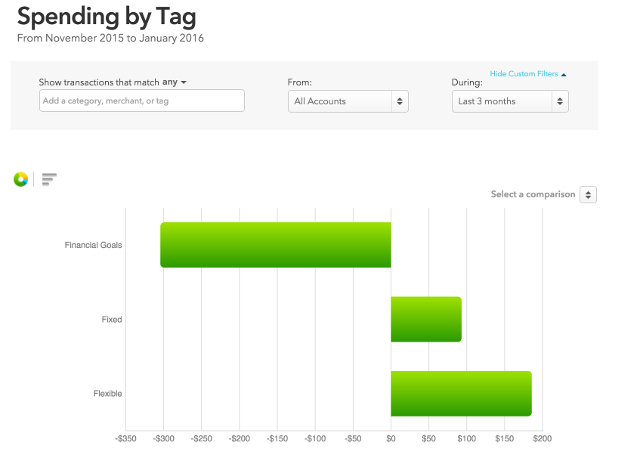

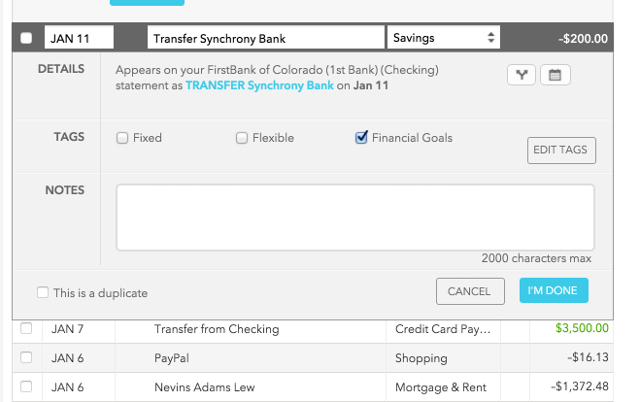

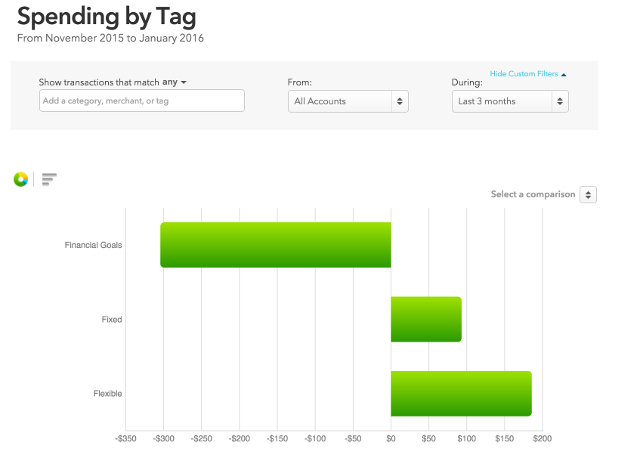

While putting each transaction into a category is a great way to keep everything organized, you can also monitor others sorts of things using tags. For example, there’s one school of thought that says 20% of your income should go to your financial goals, 30% should go to flexible costs, and 50% should go to fixed costs. Below, I’ve added Fixed, Flexible, and Financial Goals as tags.

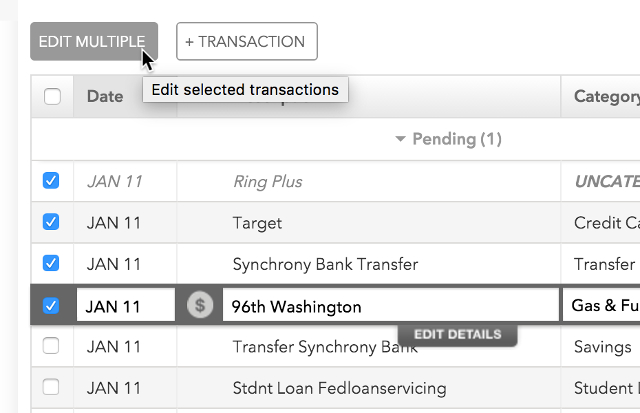

To add a tag to a transaction, click Edit Details from the transaction screen—you’ll now be able to check a box to add any existing tag, or click Edit Tags to add or remove tags from the list. You can also select multiple transactions and use the Edit Multiple menu to add the same tags to all of them.

Now, to see how your transactions are split up among your tags, go to the Trends tab, and select By Tag under Spending (or Income, if applicable). You can see how your transactions are split between your tags.

You can use these tags for a wide variety of purposes — you’re really only limited by your imagination! If you have good ideas for the uses of tags in Mint, share them in the comments so others can try out your system, too.

Mint comes pre-built with a lot of budgetary categories, but you’ll probably find that you need more. For example, in my account, I now have two separate income categories: one for my earnings and one for my wife’s. I also created a “Savings” budget to track how much we put into savings, and a “Media” category that includes both books and games.

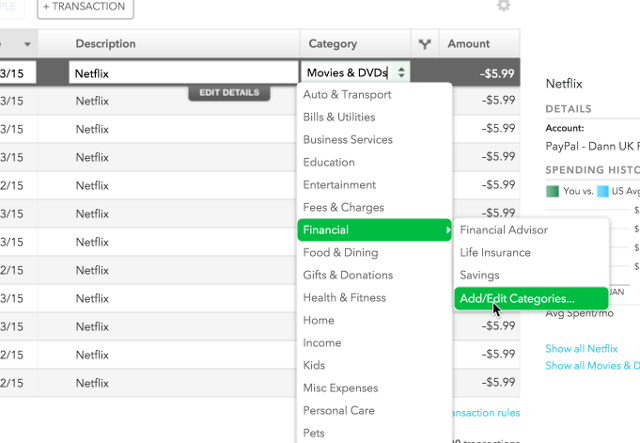

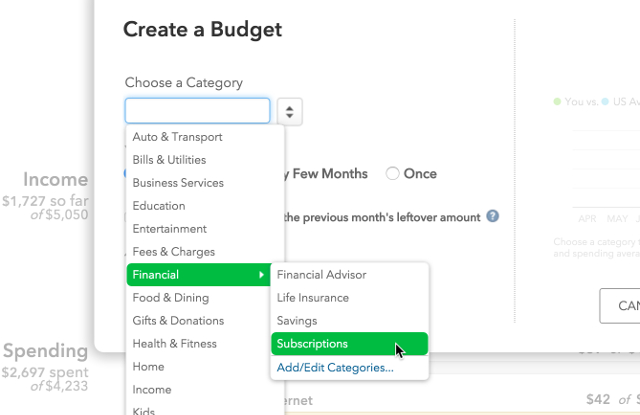

Let’s take a look at how to create and track a custom budget category. First, you’ll need to find an item in your transactions menu that will be included in this category. As an example, I’ll create a new budget called Subscriptions that will include Netflix. After finding a Netflix charge, I click on Add/Edit Categories in the menu under Financial.

After adding “Subscriptions” as a category in that window, all we need to do is go to the Budgets screen, where you can create a new Budget for that category. Hit + Create a Budget, choose Subscriptions from the drop-down, and fill in the rest of the information. Now, that budget can be set up with alerts, monthly rollover, and all the rest of the cool things Mint does with budgets.

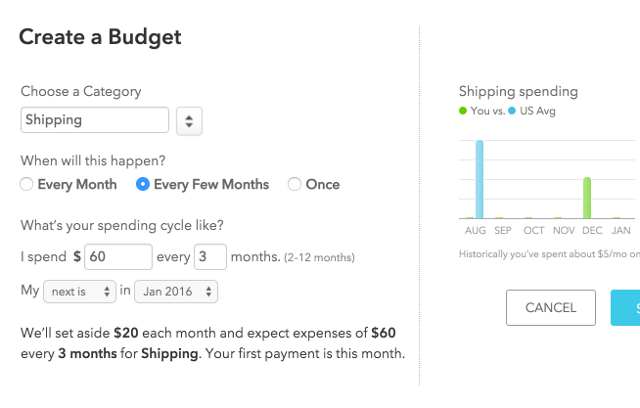

This is a very simple tip, but it can be really useful if you have some expenses or sources of income that don’t happen every month. To edit a budget, just click Edit Budget from the Budgets tab. Now, select Every Few Months, and you’ll be able to choose the number of months that you’d like your budget to cover. Easy!

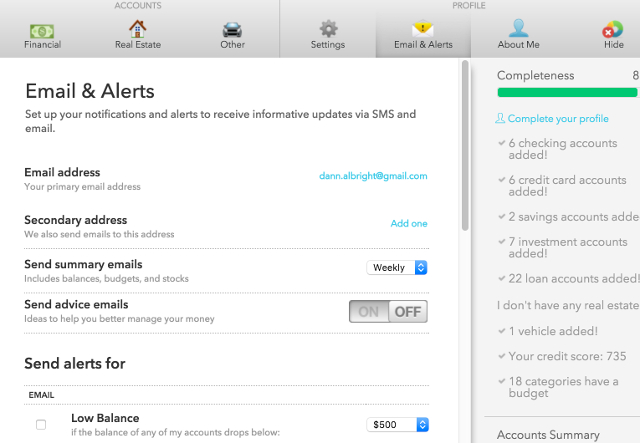

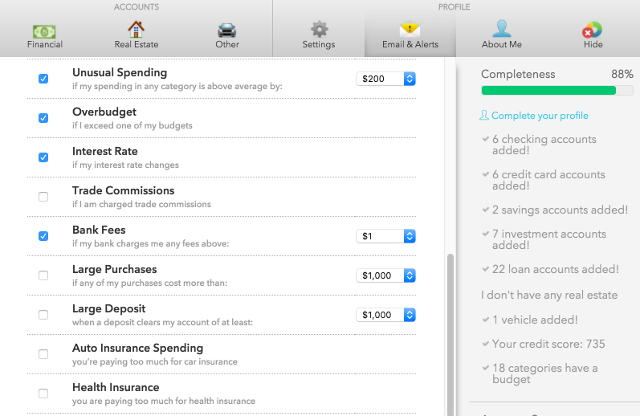

When you first open your Mint account, some notifications will be automatically set up, but you can customize them so they’re maximally useful to you. To get to the Email & Alerts screen, just click on your name or email address displayed at the top of the screen, then select Email & Alerts from the pop-up pane.

Here, you can see that there are a lot of different notifications you can take advantage of. You’ll also see the email address that the notifications will be sent to, and the option for including a second email address, which is great for including a spouse on alerts. You can also get weekly or monthly summary emails, and financial advice emails, if you like.

Scrolling down the list, you can see all the types of things that you can get alerts for, and how you can customize them. You can get a notification if any account drops below a certain amount, for example, and you can choose the amount that trigger the alert, from $0 up to $2,000.

Bill reminders, remaining credit available, change in interest rates, and a wide variety of other notifications are available. The ones that I recommend leaving on are Low Balance, Unusual Spending (which could alert you to credit card fraud) and Overbudget. You might find the others useful, but these are the ones that I think most people will find to be the best.

With these advanced tips, you should be able to deal with just about any financial information you need to keep track of in Mint. Combine that with some free tax software, a few easy ways to invest, and a steady diet of good financial information, and you’ll be on your way to financial to success!

Have you used these strategies in Mint? What else have you found useful for managing your finances? Share your best tips and any question below!

Disgaea 5: Alliance of Vengeance Wiki – Everything you need to know about the game .

Disgaea 5: Alliance of Vengeance Wiki – Everything you need to know about the game . Life Is Strange Episode 5: How to Get All Optional Photo Achievements and Trophies

Life Is Strange Episode 5: How to Get All Optional Photo Achievements and Trophies 6 Tips for Getting More Gold, Cards, and Dust in Hearthstone

6 Tips for Getting More Gold, Cards, and Dust in Hearthstone Top 10 Best RPGs of 2014

Top 10 Best RPGs of 2014 Borderlands Guide

Borderlands Guide