Cash is old news. The next time your friend or family member covers you for dinner, a movie ticket, or even a night out on the town, there’s an easier and classier way to pay them back — one that doesn’t involve inconvenient dollar bills.

All you need is a smartphone.

Between the well-established Venmo and the newly-revamped Google Wallet, there are two easy ways to instantly transfer money between users. But which one should you use: the tried and true or the fresh newcomer? Here’s what we think.

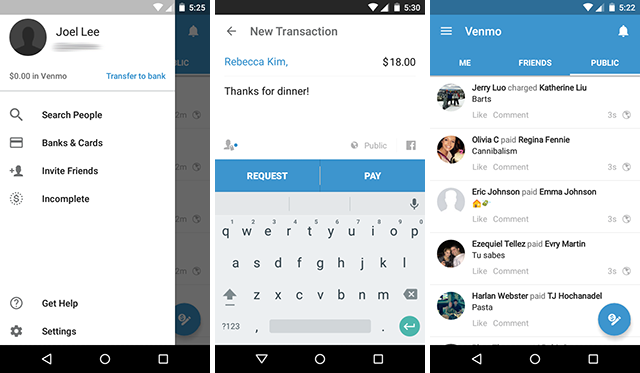

Venmo is so easy to use that you can be up and running in just a few minutes. Once you’ve created an account and signed into the app, all you have to do is connect a bank account, a debit card, or a credit card. Venmo uses bank-grade security and encryption, so no need to worry about that.

Once you have a money source connected, you can make payments to anyone as long as you have their Venmo username (if you don’t, you can always search by the recipient’s name in the app). Payments can have notes attached to explain what the payment is for, e.g. dinner or rent. Transfers only take a few seconds.

The recipient must have a Venmo account.

Be aware that bank and debit payments are free, but credit cards have a 3% fee. When received, money is stored on your Venmo account and can be used to make more Venmo payments in the future — or you can withdraw it to a connected bank account in as quickly as one business day.

And lastly, you should know that Venmo is a semi-social network. You can add users as friends, which is convenient for those you frequently exchange money with, but Venmo also has a “payment feed” that shows the money activity going on in your network of friends. (Fortunately, payments can be made privately if desired.)

Download It Now: Venmo via Play Store

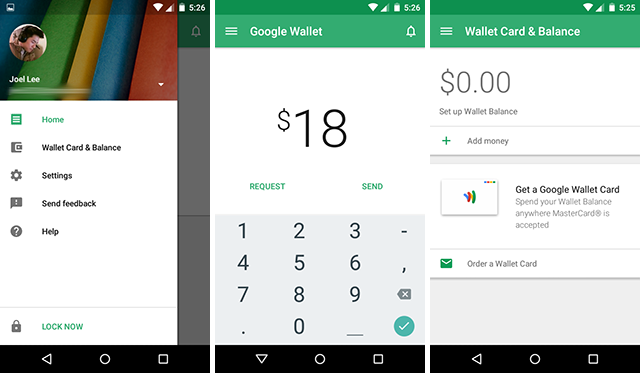

Google Wallet is a new entity now. It used to be a confusing mess, but Google did a great job revamping it into something that everyone can benefit from. Essentially, it’s like a more streamlined version of Venmo with just as much utility.

Wallet is a separate account with its own balance. You can connect a bank account or debit card to deposit money, but unlike with Venmo, no credit cards. The good news is that you can send money to anyone, even if they don’t use Wallet. All you need is the recipient’s email address.

What’s really cool, however, is that Google provides free “Wallet Cards”, which are basically debit cards that use your Wallet balance instead of your bank account balances. You can order a Wallet Card from right inside the app, and yes, it’s really free.

There aren’t any fees, but there is a generous limitation: when sending, receiving, or reloading your balance, each transaction is limited to $10,000 and there’s a limit of $50,000 in any given five-day period.

Be careful that you don’t confuse Google Wallet with Android Pay, which is a system for making payments at stores, whether by using NFC terminals or just checking out online. Google Wallet, on the other hand, is just for person-to-person payments.

Download It Now: Google Wallet via Play Store

It’s a tough call, and the answer really depends on where you are right now and which tool you’re already using, if any.

For those who aren’t using either of these apps yet, we recommend going with Google Wallet simply because it can send payments to anyone, even to those who don’t have Google Wallet accounts. This is a hard-to-beat feature, and the provided Wallet Card is a big bonus.

For those who are already avid Venmo users with many friends who are also already on Venmo, we recommend that you stick with Venmo. Functionally, it works as well as Google Wallet and there isn’t much reason to switch over. (Unless you really want a Wallet Card, I suppose).

If neither of these excite you, then you may want to try a third option in Square Cash. It’s closer to Venmo than Google Wallet, and certainly the least popular of the three, but it’s definitely a viable alternative.

These are all so easy to use that you probably won’t care about potential innovations like selfie-based payments.

Between Venmo and Google Wallet, which do you prefer? Is there a clear winner here? Share your thoughts with us in the comments below!

How I Learned to Stop Worrying and Love Dark Souls

How I Learned to Stop Worrying and Love Dark Souls Tornado in the Trailer Park

Tornado in the Trailer Park Star Wars: Battlefront (PS4) overview

Star Wars: Battlefront (PS4) overview No Hidden Cost: 7 Free-To-Play Games That Are Actually Free

No Hidden Cost: 7 Free-To-Play Games That Are Actually Free Black Ops 2: Nine Things Treyarch is Doing Differently

Black Ops 2: Nine Things Treyarch is Doing Differently