Many of us are so addicted to our smartphones that we consider it a crisis when our phones are lost, broken, or stolen. Some of us can’t even go a single day without them, and losing your smartphone is as bad as — if not worse than — losing your keys or your wallet.

And what about the price of these things? Nearly every next-generation smartphone will cost you at least $500, which makes them more expensive than an entry-level self-built computer. When a device is this important and this expensive, it probably makes sense to insure it against catastrophes.

Not all smartphone insurance plans are worth the value though. You have to balance the price of the plan against the protections you get, and then weigh all of that against the value of your device. For most, cheap insurance plans are actually more than enough.

All iPhones come with a limited warranty that includes one year of “hardware repair” coverage and 90 days of technical support. If this isn’t enough for you, Apple offers extended coverage with their AppleCare+ plan, which is actually pretty darn good for how much it costs.

Eligibility: Only for iPhones up to iPhone 6s Plus. Must be purchased within 60 days of device purchase.

Plans: AppleCare+ is a one-time purchase that extends coverage on an iPhone to two years after the purchase date of the device. For iPhone 6s and iPhone 6s Plus, it costs $129 (about $5.38 per month). For earlier models, it costs $99 (about $4.13 per month).

Deductibles: Each claim has a service fee equal to the plan price, so $129 per incident for iPhone 6s and iPhone 6s Plus and $99 per incident for earlier models.

Protections: Two incidents of “accidental damage” coverage — each subject to service fees — and “repair or replacement” coverage for your iPhone, battery, and included accessories. No loss or theft protection.

Other Details: To initiate the service, you can take your device to any authorized Apple retailer, or you can contact Apple for mail-in through UPS or USPS with no shipping charges. For express replacement, Apple will send you a new device right away and ask for you to send your device in to complete the transaction.

All Samsung phones come with a manufacturer’s warranty that includes one year of coverage for any malfunctions that occur during “normal use”. Their Protection Plan increases coverage and extends the length of coverage.

Eligibility: Only for Samsung smartphones.

Plans: Samsung Protection Plan is a one-time purchase that extends coverage on a Samsung phone to two years after the purchase date of the device. It costs $99 (about $4.13 per month).

Deductibles: A flat $79 per claim for all devices, but only applies for claims that involve “accidental damage”.

Protections: Mechanical and electrical breakdowns that occur during “normal use” of the device, plus “accidental damage” including drops, spills, and cracked screens. No loss or theft protection.

Other Details: The plan allows up to two replacements in any given 12-month period. Once a claim is approved, replacements are shipped and guaranteed to arrive by the next business day. Shipping is prepaid for returning your defective device.

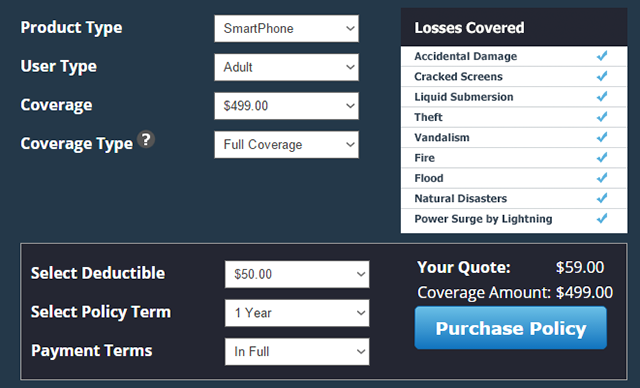

Worth Ave. Group (WAG) started as a company that insured the personal property of college students, but is now best known for their insurance plans for consumer electronics including smartphones, laptops, gaming systems, and cameras. They’ve been around for over 40 years.

Eligibility: WAG offers general cell phone insurance plans as well as a more specialized plan specifically for iPhones. For the generic plan, most brands and models are supported but not all of them are, so you should check their models list to make sure.

Plans: iPhone plans start at $54 per year (about $4.50 per month) for $400 of coverage, up to $81 per year (about $6.75 per month) for $950 of coverage. Other smartphones start at $27 per year (about $2.25 per month) for $199 of coverage, up to $78 per year (about $6.50 per month) for $899 of coverage.

Deductibles: A flat $50 per claim for all devices.

Protections: All plans are “full coverage” only, which includes accidental damage, cracked screens, liquid submersion, theft, vandalism, fire, flood, natural disasters, and power surges.

Other Details: After filing a claim, you’ll be contacted by an adjuster to determine proper course of action. If a repair is needed, WAG will handle it at their repair shop. If a replacement is needed, you will be reimbursed for the device’s replacement cost, which is determined by the adjuster.

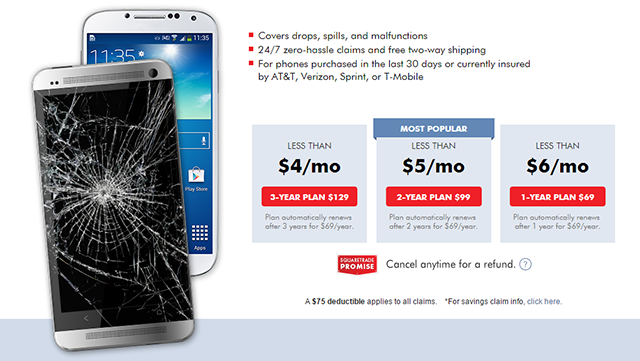

SquareTrade offers protection plans for consumer electronics in the form of extended warranties, and while they deal in all kinds of electronics beyond smartphones, their smartphone plans are some of the best non-provider third-party plans currently available.

Eligibility: SquareTrade can cover all smartphones. Must be purchased within 30 days of device purchase, or if not, the device must be currently insured through AT&T, Verizon, Sprint, or T-Mobile.

Plans: $69 per year, but there are discounts for first-time customers who buy multiple years at once ($99 for 2-year plan, $129 for 3-year plan).

Deductibles: A flat $75 per claim for all devices.

Protections: Coverage includes damage from drops, spills, liquid submersion, and mechanical and electrical malfunctions that occur during “normal use”. No loss or theft protection.

Other Details: SquareTrade has an option where you can pay for repairs at a local repair shop and SquareTrade will reimburse you for it, which is great when you need an immediate fix or if you’re traveling abroad. Otherwise, repairs and replacements are both shipped overnight.

A lot of people have never heard of Protect Your Bubble, which is a shame because their protection plans are some of the best around. They’re backed by a Fortune 500 company and they serve the U.S., the U.K., Ireland, and Brazil, so you can rest assured that they’re quite serious about what they do.

Eligibility: Protect Your Bubble will cover any smartphone, no matter the model or carrier, as long as it’s less than three years old.

Plans: $5.99 per month regardless of device.

Deductibles: A flat $50 per claim for all iPhones and other smartphones except for Samsung touchscreen phones, which have a flat $150 per claim deductible.

Protections: Coverage includes accidental damage, liquid damage, and mechanical and electrical breakdowns that occur during “normal use”. No loss or theft protection. No coverage for cosmetic, pre-existing, or intentional damage.

Other Details: There is a 14-day waiting period between purchase of the plan and when the protection begins. An unlimited number of claims can be made during the course of the plan. If a replacement is necessary, it is shipped overnight.

Let’s say you get a two-year protection plan and end up making one claim during that time. You’d end up paying anywhere from $99 to $192 for the premium, plus somewhere between $50 and $99 for the deductible. The total cost would be anywhere from $149 to $291.

If your phone expensive enough to justify that? If it’s a high-end model, then yeah, maybe. But for most people, insurance may not even be worth the cost. The only people who really benefit are those who have a history of dropping and/or breaking their devices.

You’ll notice that none of these plans cover loss or theft. Fortunately, you can freely protect against those using device-tracking services for iPhones, for Androids, and for Windows Phones. Also, check with your homeowner’s or renter’s insurance policy, as it may cover instances of theft or loss.

Do you keep your smartphone insured? Why or why not? If you have any horror stories where insurance came to the rescue, we’d love to hear them. Share with us in the comments below!

The Oculus Rift Is Real and You Can Have One in Spring 2016

The Oculus Rift Is Real and You Can Have One in Spring 2016 Omega Quintet (PS4) tips

Omega Quintet (PS4) tips Calling for help? Mr. Pacman

Calling for help? Mr. Pacman Splinter Cell Blacklist Review – Full-On Summer Blockbuster

Splinter Cell Blacklist Review – Full-On Summer Blockbuster Top 10 Best iPad 2 Games

Top 10 Best iPad 2 Games