According to Plaxo, one-third of smartphone owners have lost or broken their phones (including an astounding 19% that dropped them in the toilet).

The thought of breaking a phone sends chills down the spine of even the hardiest road warrior, and makes a lot of people wonder if they should buy insurance to cover their phone. But what does smartphone insurance cover? What does it cost? And after all is said and done, is it worth it? Let’s take a look.

Obviously this is an important factor when considering whether to get an insurance plan for your phone. Different surveys have found different results, and it’s obviously in the best interest of insurance providers to make it seem like everyone is going to lose or break their phone.

In truth, the risk depends very much on your personal habits. For instance, a lot of phones get broken at sporting events. If you go to a lot of games, you’re probably more likely to break your phone.

Women are more likely to have their phones stolen, so women may want to consider plans that have better theft coverage. Men are most likely to break their phones in the garage, and more likely to lose their phones, and these factors could play into the insurance coverage that you choose, and therefore the price.

The best idea is to reflect — honestly — about how likely you are to lose or damage your phone. It depends on your habits, hobbies, and maybe even your personality. Be honest with yourself before you start looking at the specific plans, and you’ll have a much better idea if you’re getting a good deal.

When you’re thinking about smartphone insurance, this is an important question to answer. Different insurance plans cover things; for example, SquareTrade’s insurance plan covers pretty much any hardware issue you could have, including a cracked screen, and spill or full immersion liquid damage. That’s just about anything that can go wrong with your phone. It doesn’t cover loss or theft, though.

So you’ll need to think about what you want the insurance for. If you live in an area where smartphone theft is a real issue, SquareTrade’s plan might not be for you, even though they say that you’re ten times more likely to break your phone than to lose it or have it stolen. Safeware, another provider, does cover loss and theft, though the premiums you’ll pay will be higher. These are the kinds of trade-offs you’re looking at.

If you have specific worries about damage that you might incur to your phone, it’s good to make sure that your plan has good coverage for that particular form of damage. For example, most insurance plans will cover liquid spill damage, but not all of them cover full immersion. If you think you’re likely to drop your phone in a pool or a lake, you’ll want immersion coverage.

Extended warranty plans, like AppleCare or Samsung Protection Plus, tend to cover less than a smartphone protection or insurance plan. For example, Samsung Protection Plus only covers “[p]roduct hardware failures due to normal wear and tear,” as well as accidental damage caused by drops, liquid spills, and cracks. AppleCare is similar. For how expensive they are, they just don’t compete with third-party options.

The cost of your plan might be the most important factor when determining whether or not you should get smartphone insurance. Let’s take a look at SquareTrade. Their most popular plan, which lasts for two years, costs $99 (though it goes up to $69 per year after that). There’s also a $75 deductible for any claim that you make, so over two years, if you make one claim, you’ll be looking at $175.

Another third-party insurance plan, Protect Your Bubble, starts at $6 per month, which adds up to $144 over two years. And the deductible is $50, so a single claim in two years of coverage will run your total to $194, not much different than SquareTrade. When I got a quote from Safeware on a new Sprint iPhone 6 16GB, it came to $182 for two years, plus a $50 deductible, adding up to $232 for a plan and a single claim.

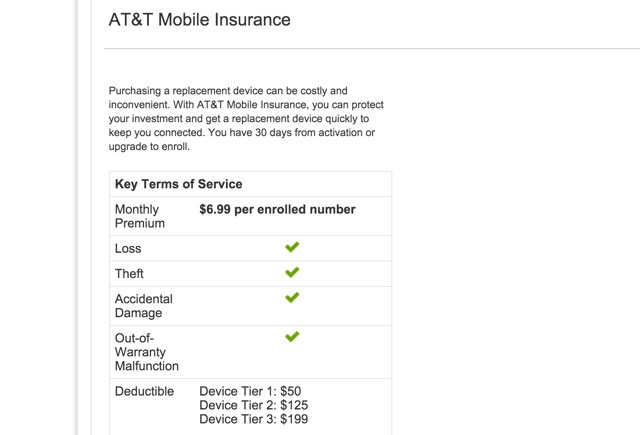

You can also get protection plans from cell phone service providers (though you shouldn’t be buying phones from them in the first place). For example, AT&T offers a $7-per-month plan ($168 for two years) that covers loss, theft, accidental damage, and out-of-warranty malfunction. They also have a deductible of $200 for the newest devices, though older devices may qualify for a lower deductible. Plan members are also limited to two claims per year. Two years with a single claim would run you $368.

Best Buy’s Geek Squad protection plan costs $160 for two years, and they advertise no deductibles (though immersions are not covered). The Geek Squad protection plan plus loss and theft coverage totals $240 for two years.

As you can see, the amount you’ll pay for smartphone insurance can vary quite a bit, but most of the popular plans fall between $175 and $250 for two years, including one replacement claim. Which is a lot less than paying to replace your phone at full price, which could easily cost upwards of $500 or $600. And if you don’t have to make a claim over the two years of your protection plan, the cost that you’ll pay is even less.

As with many types of insurance, whether or not smartphone insurance is worth the cost depends largely on how you feel about being insured. If having a protection plan on your phone will give you peace of mind, then it could be worth the cost for two years of insurance.

If you’re careful with your devices and tend not to have many problems with them, you could assume some of the risk and put that money to better use.

When deciding whether or not you should purchase smartphone insurance, it’s important to compare the small details of available plans. For example, if you have an iPhone, you may want your insurance to cover theft, as iPhone resale values are extremely high — whereas if you have an LG phone, that may be less of a risk. If you spend a lot of time on the water, having immersion coverage, instead of just spill, might be worth paying a little more for. If you’re just worried about dropping your phone, pretty much any plan will do.

Some plans also offer additional coverages, such as a certain amount of money in unauthorized calls. Others might charge more for a claim placed within the first 90 days of your coverage. If you travel a lot, getting a plan that only covers you in your home country might not be enough. There are a lot of little distinctions between different plans, and looking at the terms and conditions of each one will help you figure out exactly how they differ.

In short, if you’re really nervous about breaking or losing your phone, and $200 will give you two years’ worth of reassurance, it very well may be worth it. Compare plans and go for it (remember that third-party plans are almost certainly going to be the best deal).

On the other hand, if you’re not worried about breaking or losing your phone, go ahead and skip the insurance. Take good care of your phone, but know that if you break it, you could be out another $500.

Have you done the cost-benefit analysis on smartphone insurance? What did you determine? Is your current phone insured? Have you had to use your plan?

Share your experiences below, and let us know if you’d recommend smartphone insurance to others!

Image Credits: Agris Krusts via Shutterstock.com, Africa Studio via Shutterstock.com, BLACKDAY via Shutterstock.com, lOvE lOvE via Shutterstock.com

Destiny: House of Wolves Wanted Bounty Location Guide (May 26 Week): Wolf Scavenger, Queenbreaker and Ether Runner

Destiny: House of Wolves Wanted Bounty Location Guide (May 26 Week): Wolf Scavenger, Queenbreaker and Ether Runner How to Install Firefox Add-ons Manually (Even From GitHub!)

How to Install Firefox Add-ons Manually (Even From GitHub!) Your Guide to Every Weapon in Far Cry 4

Your Guide to Every Weapon in Far Cry 4 Modding the Sky - How Fans Fix Skyrim One Mod at a Time

Modding the Sky - How Fans Fix Skyrim One Mod at a Time Fallout 4 Guide: How to Romance Piper

Fallout 4 Guide: How to Romance Piper